35+ Mortgage extra borrowing calculator

Mortgage reserves arent usually required for VA. The results displayed are based on the information you have entered.

Your Adjustable Rate Mortgage Needs To Be Refinanced

Free interest calculator to find the interest final balance and accumulation schedule using either a fixed starting principal andor periodic contributions.

. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. If you want help and support with your application call a Mortgage Assistant. Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72t early distribution analysis.

How can you calculate potential savings from an offset account. The mortgage calculator from Lloyds Bank can help you compare mortgages understand how much you could borrow and what your mortgage repayments would be. Access your home equity when you need it.

Lenders define it as the money borrowed to pay for real estate. Applications are subject to status and lending criteria. If we do reduce your monthly payments the term of your mortgage will stay the same and you will pay off your mortgage in the same amount of time.

Easily increase or decrease mortgage payments. Calculator is for illustrative purposes only. The mortgage amortization schedule shows how much in principal and interest is paid over time.

Decrease by increments of 5 to a minimum of 5. A chattel mortgage calculator comes up with a repayment amount based on the information you provide using basic arithmetic. VA lenders calculate how much free cash you have each month after paying your monthly obligations.

The 72t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. Try this free feature-rich mortgage calculator today. The requirements vary based on your family and home size as well as the location of your home.

If you would like to pay off your mortgage sooner than planned please contact us on 0345 30 20 190 Relay UK - 18001 0345 30 20 190. How to know when you can afford to buy an investment property. Get a quick estimate of what your monthly payments will be for one of our mortgages.

A mortgage is a loan secured by property usually real estate property. Monthly Capital Interest. This monthly payment protects the bank against the risk of loan non-payment.

Each lender is different but generally speaking if you have a score above 720 youll have access to better borrowing rates. So lets go back to the example of Derek borrowing 100 from the bank for two years at a 10 interest rate. You could potentially in some circumstances borrow up to a maximum of 90 of the value of your home.

The interest rate will remain the same for the term of the mortgage. It offers amortization charts extra payment options payment frequency adjustments and many other useful features. Applicants must be UK residents aged 18 or over.

If you add an extra payment the. Please note this calculator is for educational purposes only and is not a denial or approval. 15 20 years.

There are options to include extra payments or annual percentage increases of common mortgage-related expenses. For the first year we calculate interest as usual. Some foreign countries like Canada or the United Kingdom have loans which amortize over 25 35 or even 40 years.

Manulife One is an all-in-one readvanceable mortgage and banking product that lets you combine your mortgage with your bank accounts short-term savings income and other debts. Private Mortgage Insurance PMI 0 to 1. Investing in property is often seen as the less risky form of investment unlike stocks or managed funds that can require specialised knowledge to get a foot in the door.

With Manulife One you can. Our mortgage refinance calculator can help borrowers estimate their new monthly mortgage payments the total costs of refinancing and how long it will take to recoup those costs. Increase by increments of 5 to a maximum of 35.

To illustrate savings weve made the following assumptions. It is only required on a typical conforming mortgage if you pay less than 20 down until you have at least 22 equity in the home or 20 equity and you request the fee removed. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

See how those payments break down over your loan term with our amortization calculator. The calculator is mainly intended for use by US. Borrow more on your Royal Bank of Scotland residential mortgage to help realise your plans for those home improvements dream holiday etc.

The results are based on a repayment mortgage. Extra help and guidance. In our Learning Center you can see todays mortgage rates and calculate what you can afford with our mortgage calculator before applying for a mortgage.

To calculate your estimated DTI ratio simply enter your current income and payments. Unlike the DTI ratio the residual income calculator analyzes your after-tax income. What is an offset account.

03450 50 50 62 press option 2 Talk to an expert. THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. Please note the calculator does not factor in any early repayment charges.

Scores above 800 are rated as exceptional. A low minimum borrowing amount of 2000 that you can use to. Decrease down payment amount.

Using an offset account has the potential to save you a lot more than a standard savings. Accessibility statement Accesskey 0 Skip to Content Accesskey S. Reduce your interest costs and become debt-free sooner.

If you receive extra money such as a work bonus tax refund or inheritance make a one-time payment towards the principal to save interest and pay off. Well help you understand what it means for you. A mortgage offset account is a bank account linked to your home loan - money put in there can be fully or partially offset against the balance of your loan so you only pay interest on the difference.

Purchasing a property such as a house or unit can be quite profitable - especially if the purchaser takes their time to learn about how to reap. Mortgage Loan Auto. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

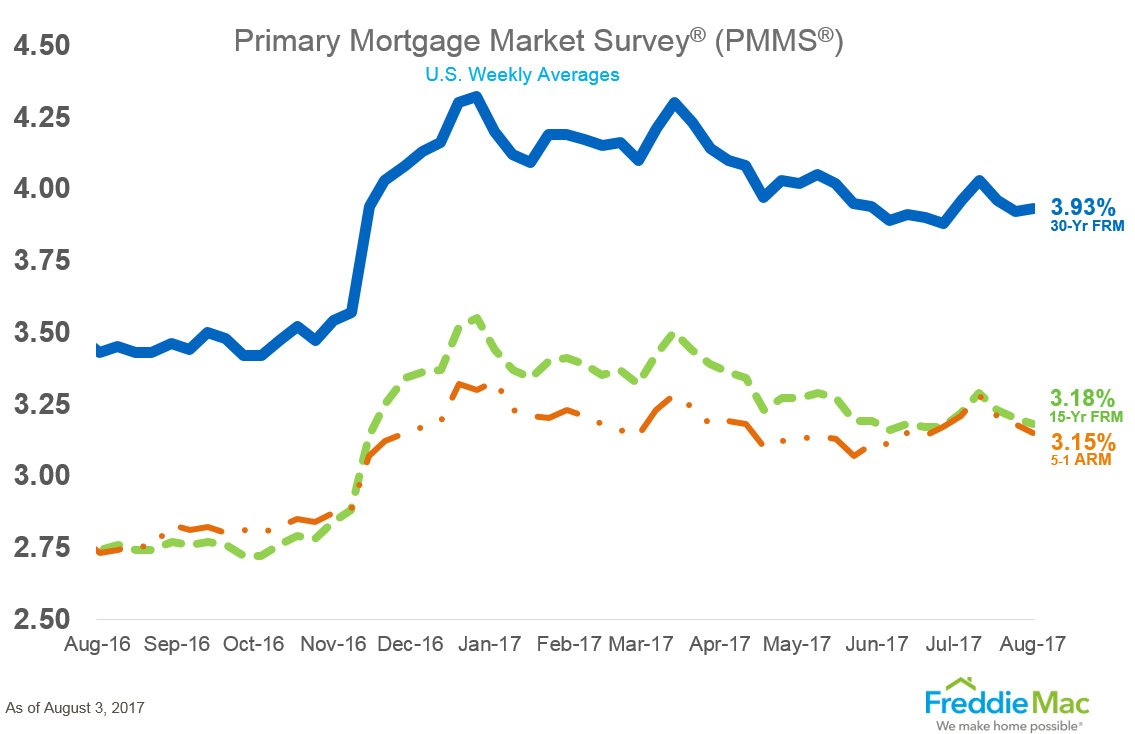

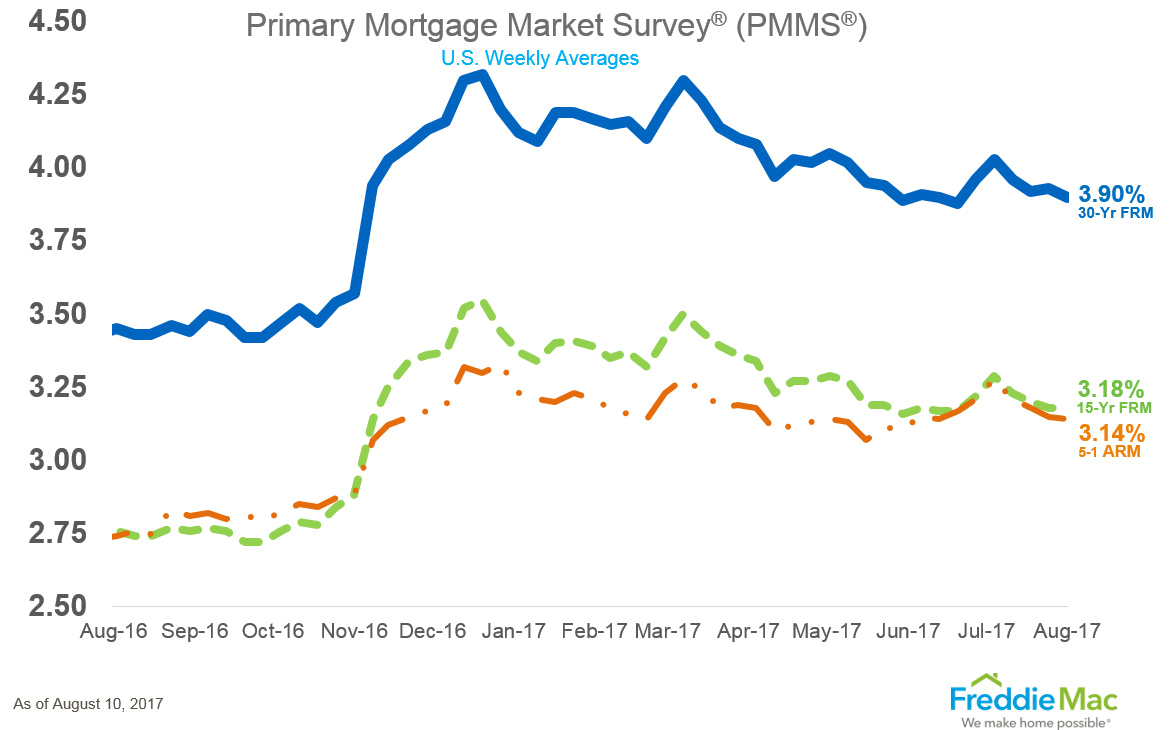

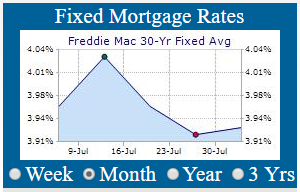

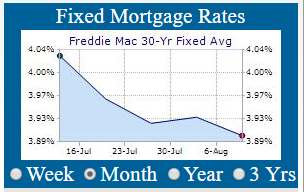

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

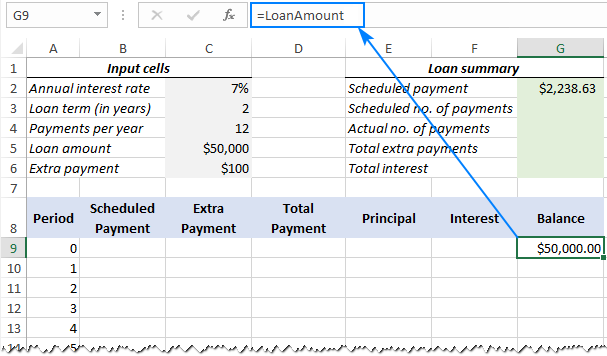

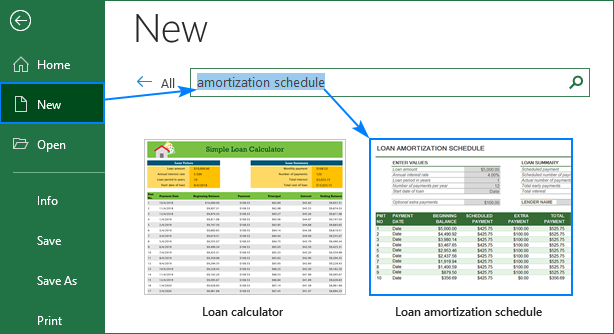

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

If You Put A Down Payment On A New Home But Fail To Get The Mortgage Do You Lose Your Down Payment Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Contribute To My 401k Or Invest In An After Tax Brokerage Account

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Excel Ppmt Function With Formula Examples